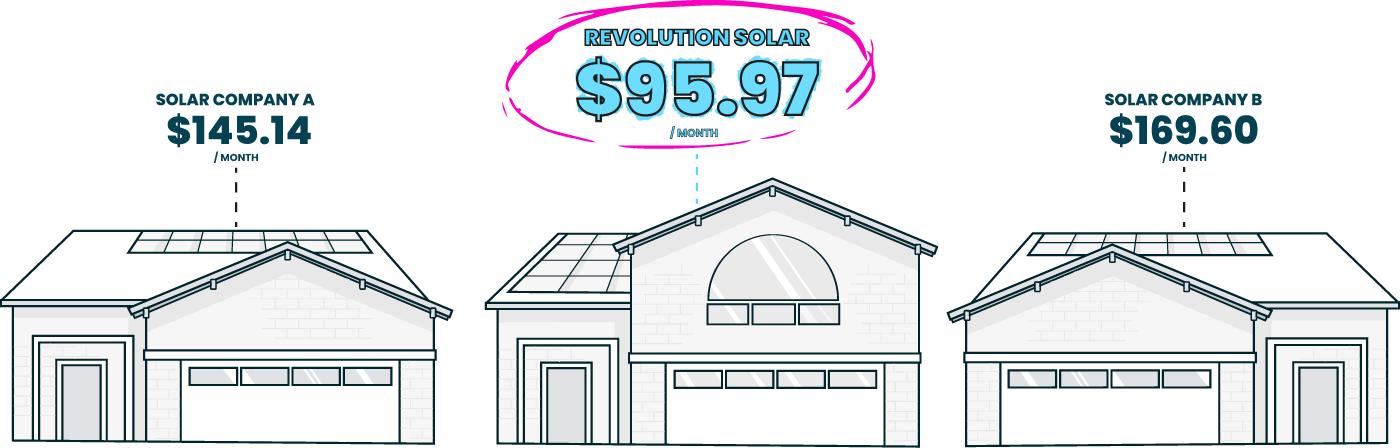

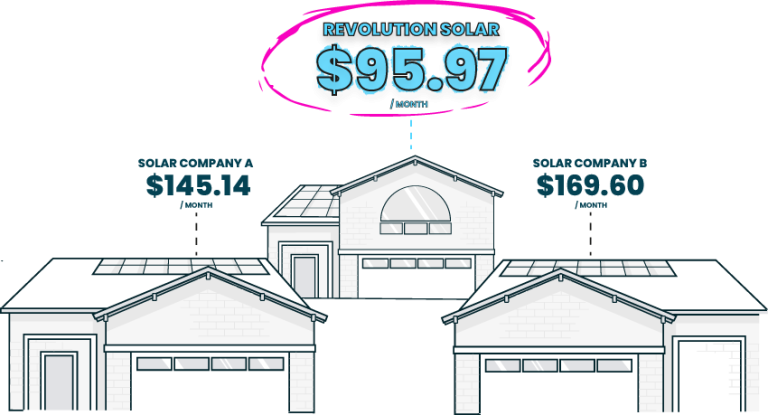

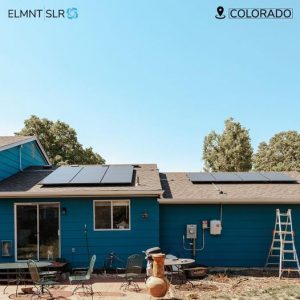

Q: How Can We Install Solar For Up To 31% Less Than The Competition?

Q: How Can We Install Solar For Up To 31% Less Than The Competition?

A: By Cutting Out The Middleman!

It's a Solar Revolution...

Terry Allan

I paid $8K LESS than my neighbor for the EXACT SAME solar system. He bought his from a Door-To-Door Salesman. I got mine through Revolution Solar. I couldn't be happier!